Dive Brief:

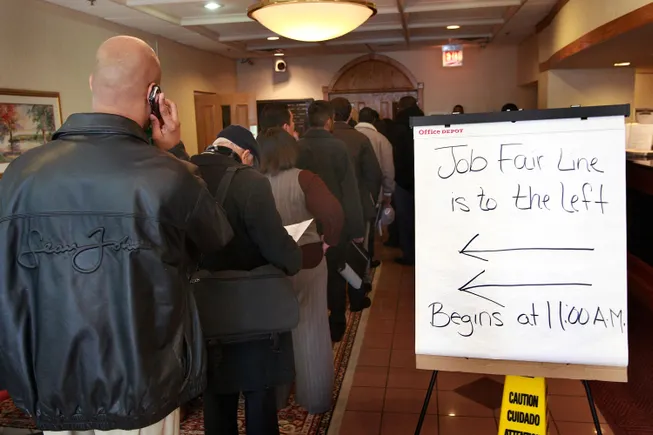

- Continuing claims for unemployment benefits rose more than forecast to the highest level since November 2021 as reductions in both hiring and firing suggest the labor market is slowing.

- Recurring applications for jobless benefits increased 37,000 to 1.97 million during the week ended June 14, the Labor Department said Thursday.

- “Rising continuing claims signal higher unemployment in June,” Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics, said Thursday. “With no reason to expect corporate hiring plans to suddenly improve, we retain our forecast that the unemployment rate will rise to 4.8%” by December, he said in a client note.

Dive Insight:

Since a meeting by Fed officials on June 17-18, two policymakers have warned of potential weakness in the job market and said they may favor a quarter-point reduction of the main interest rate at a scheduled gathering of Fed officials on July 29-30. They both noted that inflation has cooled.

Fed officials in a median projection released after last week’s meeting forecast that unemployment by the end of this year will increase from 4.2% in May to 4.5%, 0.1 percentage point higher than their March forecast.

Policymakers since their gathering have expressed different views on the outlook for the labor market.

“Should inflation pressures remain contained, I would support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market,” Fed Vice Chair for Supervision Michelle Bowman said Monday. Fed Governor Christopher Waller took a similar stance on June 20.

Fed Chair Jerome Powell and other central bankers have voiced more confidence than their two colleagues in the strength of the job market.

“Conditions have remained solid,” Powell said Wednesday in testimony to the Senate Banking Committee, noting that payroll gains “averaged a moderate 124,00 per month in the first five months” of 2025, and the unemployment rate remains historically low.

In an indication that firing may be tapering off, Labor Department data show that initial jobless claims fell more than expected to 236,000 in the week ended June 21 from 246,000 the prior week.

Like Powell, San Francisco Fed President Mary Daly also described the labor market as “solid.”

The Labor Department data released on Thursday “confirmed that now continuing claims are going up because it takes a little longer to find a job — that’s consistent with the hiring numbers just being slower as the economy comes to a more sustainable pace,” she said.

The job market is “progressing solidly, although more slowly than before,” she said in a Bloomberg Television interview.

In the same vein, Richmond Fed President Tom Barkin noted on Thursday that “job growth continues at a healthy pace.”

Still, “the current low-hiring, low-firing environment might come under threat” if tariff-induced inflation erodes profit margins and prompts companies in coming months to cut costs by trimming payrolls, Barkin said in a speech.

Leave a Reply