Lawsuits challenging employers’ regular-rate-of-pay calculations under the Fair Labor Standards Act are likely to trend higher in the coming years, Samantha Rollins Murphy, partner at Faegre Drinker, told attendees at a Nov. 19 National Employment Law Institute virtual event.

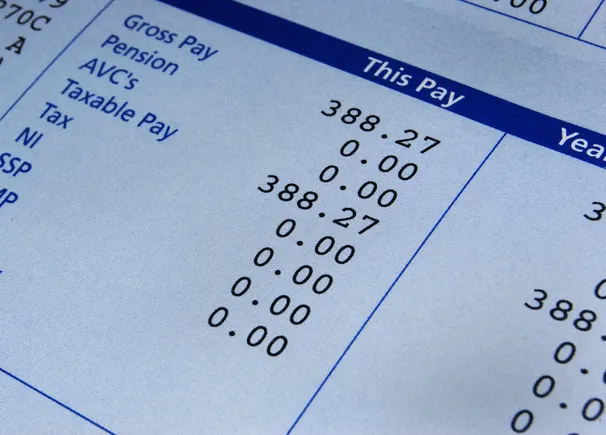

In order to determine the amount of overtime pay due to an eligible employee, employers must know the number of hours the employee has worked over 40 hours in a given workweek, as well as the employee’s regular pay rate, according to U.S. Department of Labor guidance. The rate is a function of total compensation — including wage supplements like certain nondiscretionary bonuses — divided by the number of hours worked.

The FLSA’s regulations provide an exhaustive list of payments excludable from the regular rate, but many employers still fail to ensure that they include everything that the law requires, Murphy said. She specifically identified shift differentials, attendance bonuses, safety bonuses, retention bonuses and some referral bonuses as common sticking points.

“Many employers are screwing that up,” Murphy said of regular-rate payment omissions. The legal consequences are apparent: “I am seeing more and more regular rate-only cases brought by the plaintiffs’ bar,” she added.

The trend began in states like California but is spreading in the form of nationwide collective actions, Murphy said. She encouraged employers to audit their regular-rate calculations in advance of anticipated legal challenges, which may involve costly claims from thousands of workers at once.

“This is fun litigation for the plaintiffs’ bar because it requires, frankly, very little work,” Murphy added. “They’re very much gotcha cases.”

It’s also timely for employers to do an audit, she said, given the recent passage of the One Big Beautiful Bill Act. The law will require employers to identify qualified overtime for purposes of its provision permitting workers to deduct overtime pay from their income taxes.

“You’re already going to be trying to figure out what that number is — [it’s a] great time to look at it holistically,” Murphy said.

A reminder about off-the-clock work

The FLSA requires employers to pay employees for all work suffered or permitted, even if the work is not requested by the employer. Employers must count work that is performed outside of an employee’s regularly scheduled shift — including away from the jobsite — as hours worked, as long as they knew or should have known about the work, Murphy said.

Employer knowledge of off-the-clock work features in several recent cases, and Murphy highlighted a “kind of disturbing case” decided in 2023 by the 2nd U.S. Circuit Court of Appeals in Perry v. City of New York.

In Perry, a group of first responders alleged that their employer required them to attend meetings at the beginning of their shifts during which they had to wear personal protective equipment. The plaintiffs claimed that the employer did not compensate them for pre-shift time spent putting on the equipment, despite knowing that it would take several minutes to do so, without the employees first requesting overtime pay.

The 2nd Circuit held that the employer’s policy was unlawful and that it is irrelevant whether an employer knows that work is being paid or unpaid; as long as the employer requires the work or fails to exercise reasonable diligence to discover it, the employer must pay the employee.

A broader takeaway for employers in the 2nd Circuit, Murphy said, is that employers will have an affirmative obligation to pay for pre-shift, off-the-clock work that an employee proves will result from a workplace policy or practice, even an unwritten one. That is the case despite any available processes by which employees could report such additional time, she added.

“That’s a pretty significant shift from the more typical cases in this line,” Murphy said.

Leave a Reply