Employees are the backbone of any company, and providing the best benefits possible is one essential way that employers can do their part to keep workers happy, healthy, and productive. By paying attention to benefits trends from year to year, leaders can also ensure that they provide options their employees will really use. This can help reduce employee stress and encourage them to bring their best selves to work.

Workplace benefits are so important, in fact, that Bank of America data found 39 percent of employees stay at their jobs due to competitive workplace benefits.

So, how can employers ensure they’re meeting their employee benefits needs? They might start by focusing on these three trends:

Trend no. 1: Benefits, when used properly, can give companies a competitive advantage for talent.

Why it matters: In the current labor market, flexible benefits are a competitive advantage that employers can use to recruit the best talent. “Benefits offered by employers in their workplaces — from retirement savings options to day-to-day banking to other wellness benefits — can be a make-or-break for employees when making decisions about where to work,” said Lorna Sabbia, head of Workplace Benefits at Bank of America.

Bank of America research backs this up, with 42 percent of young adults saying that additional or better-quality benefits were a key differentiator in their recruitment.

What benefits leaders can do: Designing comprehensive workplace benefits plans that align with company goals around attracting talent can improve employee financial, social, and emotional wellness. “Employers that consider holistic programs and benefits can help their employees prepare for the future by supporting their employees’ retirement readiness and well-being,” said Lorna. “Meanwhile, it also helps them stay competitive in the labor market.”

When putting together a comprehensive benefits package that will impact the largest number of employee needs, employers can consider new and emerging benefits – in addition to traditional ones like healthcare and compensation – as tools in their toolbox to attract the best and brightest.

Trend no 2: Provide more education and digital tools to support financial wellness.

Why it matters: Employees are demanding more and better financial wellness tools that they can access digitally – especially as digital engagement in general continues to soar. To that point, Bank of America alone has seen a 12% increase year over year in clients interacting with their finances digitally. Employees are looking for a simplified user experience that brings together digital solutions with expert advice to provide tailored insights, education, and guidance to help address their financial needs.

As consumers continue to lean on digital solutions to manage their financial lives and understand their benefits options, employers and benefits providers can do their best to meet employees where they are, whether that’s online or in-person.

What benefits leaders can do: To progress in this area, employers might consider offering financial wellness resources, including online financial tools, calculators and scores to help employees measure and improve their overall financial well-being. Employers can also consider smart plan design or tools like auto-enrollment to help support financial wellness for their employees. Bank of America data found that 85 percent of employees participate in their employer’s 401(k) plan when there is an auto-enroll feature, versus only 36 percent of employees without the feature.

Outside of financial wellness tools and smart plan design, employers can also consider providing more education regarding the tools they already offer that provide valuable benefits. Although 40 percent of employees have access to a Health Savings Account (HSA) — and 73 percent who have access contribute to it — understanding of HSAs has decreased over the last five years among both employees and employers. The misconceptions and lack of understanding around HSAs often prevent employees from maximizing these benefits, including their triple tax-free advantage of paying no taxes upon contributing, investment growth or distribution, when they are used for healthcare purposes.

“This knowledge gap is concerning,” said Sabbia. “When paired with a high-deductible health plan, HSAs not only provide immediate tax savings, but also offer a unique opportunity for long-term investing.”

Trend no. 3: Increasing interest in non-traditional financial and physical wellness benefits, like Lifestyle Spending Accounts (LSAs) and family-friendly benefits.

Why it matters: Employee interest in non-traditional benefits continues to grow in popularity. Smart employers are evolving their benefits packages to meet this demand. As employers continue efforts to attract the best talent, personalized benefits are a big part of attracting new generations of talent that are looking for increased flexibility, both inside and outside the work environment.

What benefits leaders can do: Although employers are already catching on — 39 percent of employers already offer family friendly benefits, and 33 percent are considering them as part of their benefits strategy over the next two years — there’s still more that could be done.

Beyond traditional health and retirement benefits, employees are seeking out wellness benefits that contribute to their overall well-being. “Employees often seek guidance from their employers on a range of persona; concerns, not just workplace or healthcare related issues,” said Sabbia. Keeping that in mind, expanding benefits coverage to include options like Lifestyle Spending Accounts — which help cover perks like gym memberships, mental health coaching, financial seminars, and pet care — may help employees feel heard and appreciated.

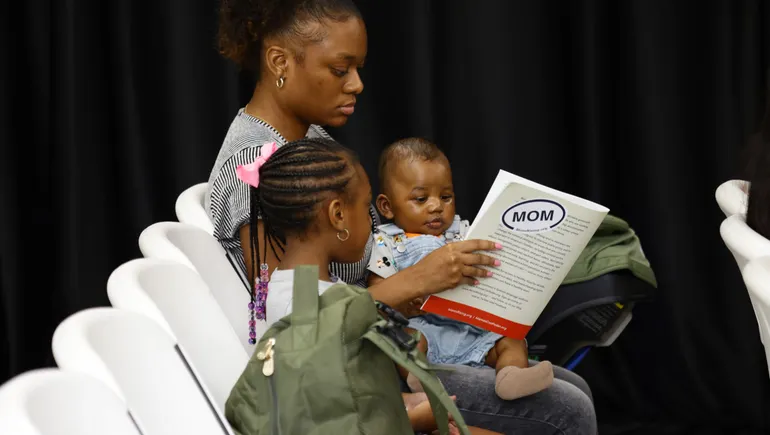

Providing better family-focused benefits is something most employees would like, as well. Things like paid parental leave, onsite childcare, and illness leave are additional ways that benefits leaders may be able to bridge the gap between the non-traditional benefits that employees say they need and what their employers provide.

For employers that already offer similar lifestyle programs, measuring the success of existing programs can also help ensure they continue to refine and optimize their benefits.

As benefits leaders seek to offer the best-of-the-best for their employees, they might do well to keep in mind that every employee is unique, and every employee is on a different financial journey. Expanding employee education about the resources available is critical to ensure employees who crave more guidance and communication on financial wellness get what they need.

Leave a Reply