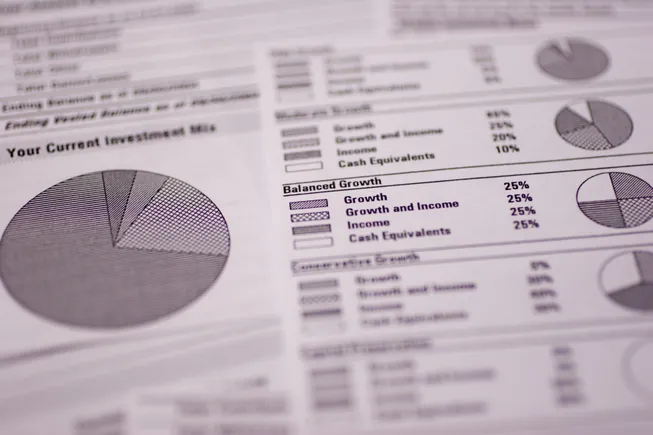

About 80% of companies with 100 or more employees pay too much in retirement plan administration fees, according to data published Oct. 24 by Abernathy Daley 401(k) Consultants.

The firm said in a press release that it conducted an “in-depth analysis” of Form 5500 filings, which applicable employers submit annually to the U.S. Department of Labor and the IRS, from more than 6,500 employers. It specifically found that employers were overpaying on administrative fees for 401(k) and 403(b) retirement plans.

Such overpayments may indicate employers are not conducting independent benchmarks of their plans to ensure compliance with federal law and alignment with internal governance standards, Abernathy-Daley said.

The firm’s report comes after a set of high-profile lawsuits brought by employees that alleged employer mismanagement of retirement plans, including excessive fee payments. According to a 2020 Aon report, at least 85 excessive fee lawsuits were filed in U.S. courts in 2020 alone, which was four times the average total number of such suits in the three previous calendar years.

In 2023, General Electric agreed to pay $61 million to a class of beneficiaries in order to settle a lawsuit alleging that the company mismanaged its 401(k) plan in part by limiting plan members’ choice of actively managed funds. A separate lawsuit filed by Cornell University employees — currently before the U.S. Supreme Court — alleged that the school failed to control and monitor administration fees in its 403(b) retirement plan.

In an interview, Steven Abernathy, chairman and CEO of Abernathy-Daley, said the fact that the firm’s analysis focused on companies with larger head counts demonstrates the challenges HR teams of all sizes face in administering retirement plans.

“Those are the most well-funded companies on the planet,” Abernathy said of the businesses the firm analyzed. “If you have under 100 employees, the chances are much higher that you’re overpaying [on administrative fees] because you don’t have the resources to have a decked out HR department that oversees this.”

Abernathy said it typically takes less than one week to complete a retirement plan benchmark analysis, but the timeline for implementation of a benchmark’s findings may depend on how quickly HR departments are able to act. That work includes selecting administrators with reasonable fee structures as well as ensuring that employees have access to high-quality investment funds.

Good communication also can be a difference maker. Abernathy said one best practice is to have a mixture of group presentations and one-on-one meetings, in which employees can meet directly with a financial educator.

Employers may not be the only party that could do more to improve plan members’ understanding of retirement plan fees. In 2021, a government watchdog organization published a report recommending that the U.S. Department of Labor take steps to help participants better understand the types of fees they paid as well as the effects of those fees on savings over time.

Leave a Reply